Free Tax Preparation & Earned Income Tax Credit

Earn It! Keep It! Save It! VITA Program

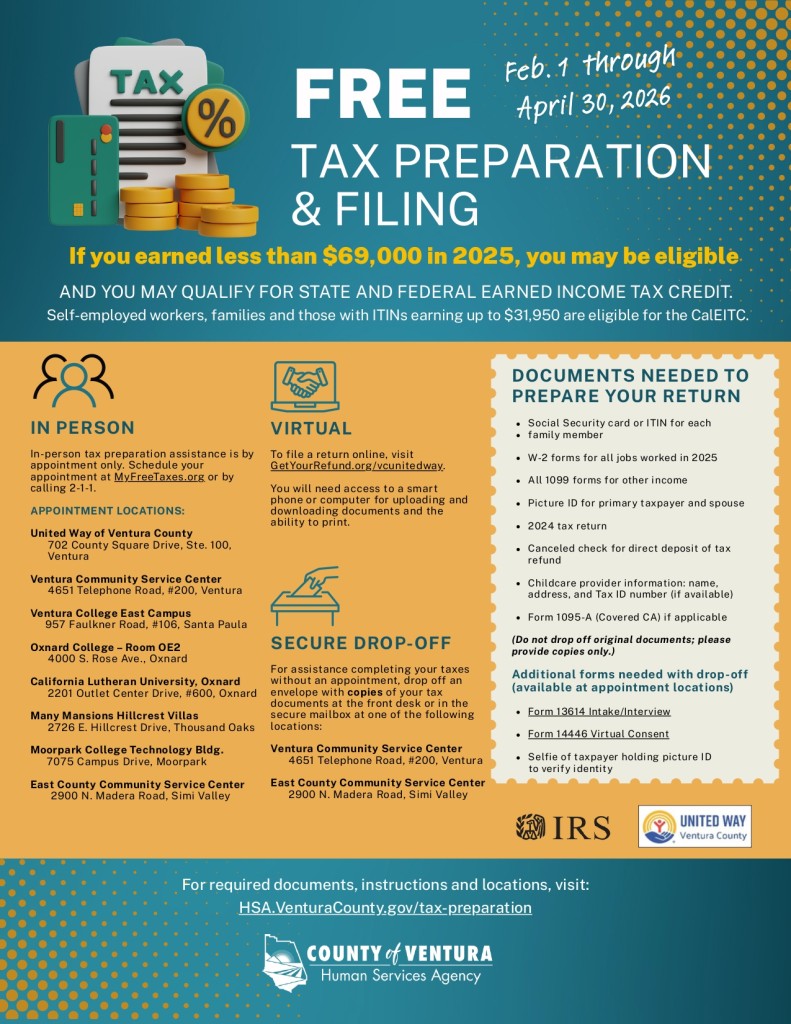

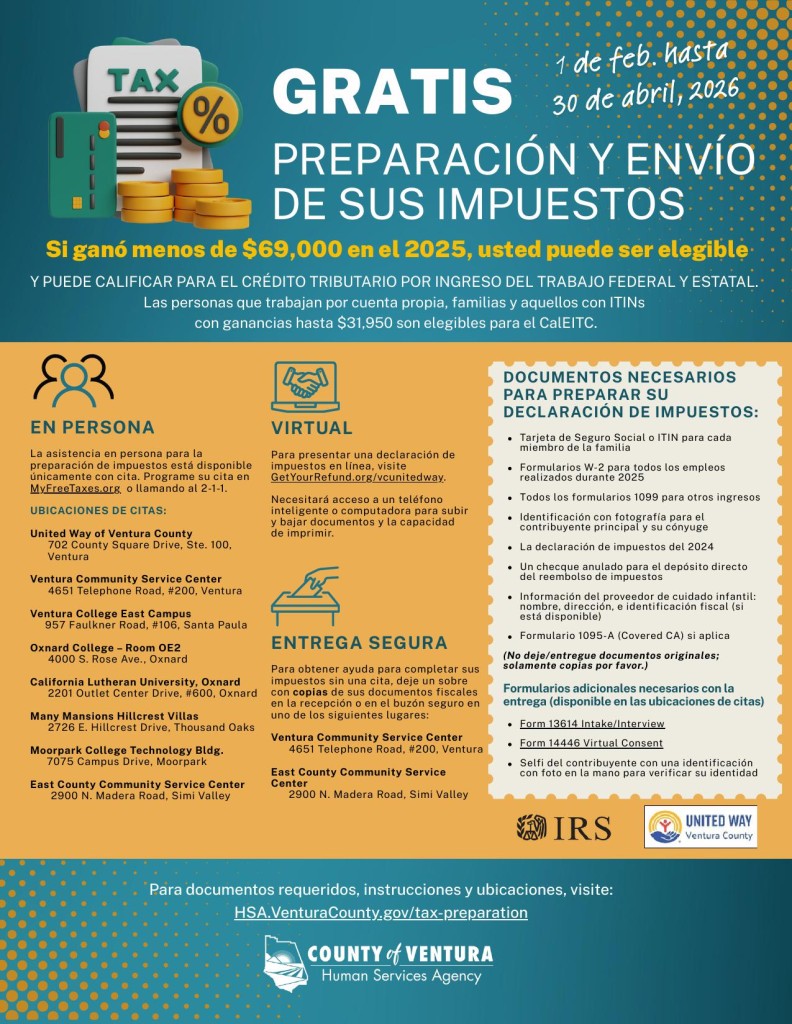

If your household income was under $69,000 in 2025, you may be eligible for free tax preparation and filing, and you may qualify for state and federal earned income tax credit. Tax returns are prepared and filed by trained tax preparation volunteers.

Self employed workers, families and those with ITINs earning up to $31,950 are eligible for the California Earned Income Tax Credit (CalEITC)

Tax returns are prepared by trained volunteers certified by the IRS

Documents needed to prepare return:

- W-2 for all jobs worked in 2025

- Copy of Social Security Card or ITIN for each family member

- Copy of all 1099 forms for other income

- Copy of picture ID for the taxpayer and spouse, if applicable

- Copy of Form 1095-A for any month(s) covered by Covered CA, if applicable

- Child Care provider information: Name, Address, and Tax ID, if available

- Canceled check, bank statement, or verification from financial institution showing account number and routing number for direct deposit of tax refund

- Copy of 2024 Tax return – pages 1 & 2, and Schedules 1, 2 & 3, if applicable

Please, copies only, no original documents.

IN PERSON – Beginning January 22, 2026 dial 211 to schedule an appointment or self-schedule at MyFreeTaxes.org

In-person sites are open from February 1 – April 30, 2026

DROP-OFF – For assistance completing your taxes without an appointment, drop off an envelope marked VITA with copies of your tax documents at the front desk or in the secure mailbox at one of the following locations:

- Ventura Community Service Center – 4651 Telephone Road, #200, Ventura

- East County Community Service Center – 2900 N. Madera Rd., Simi Valley

Lobby hours are Monday-Thursday 8:30 am to 4 pm

Secure mailboxes available 24/7

In addition to the forms listed above the following forms are needed with Drop-Off:

- Form 13614-C Intake/Interview (Formulario 13614-C en español)

- Form 14446 Virtual Consent (Formulario 14446 en español)

- Selfie of taxpayer holding picture ID to verify identity

MyFreeTaxes

One option for those with a simple return, (for example, a single filer with up to two W-2’s) you may file your taxes online for free at www.MyFreeTaxes.org. There is no income limit.

What is the Earned Income Tax Credit (EITC)

The Earned Income Tax Credit (EITC) is a tax credit for low- to moderate-income working families and individuals. The EITC can help you reduce your tax liability and, in many cases, put money in your pocket.

To qualify for the EITC, you must have worked during at least part of 2025 and meet certain income requirements.

You must file your taxes to receive the EITC, even if you did not earn enough money to be required to file.

The EITC benefit is retroactive for three years, so review whether you filed for the EITC in recent years. If you meet the eligibility requirements and have not filed for the previous three years you may be entitled to an even larger refund check!

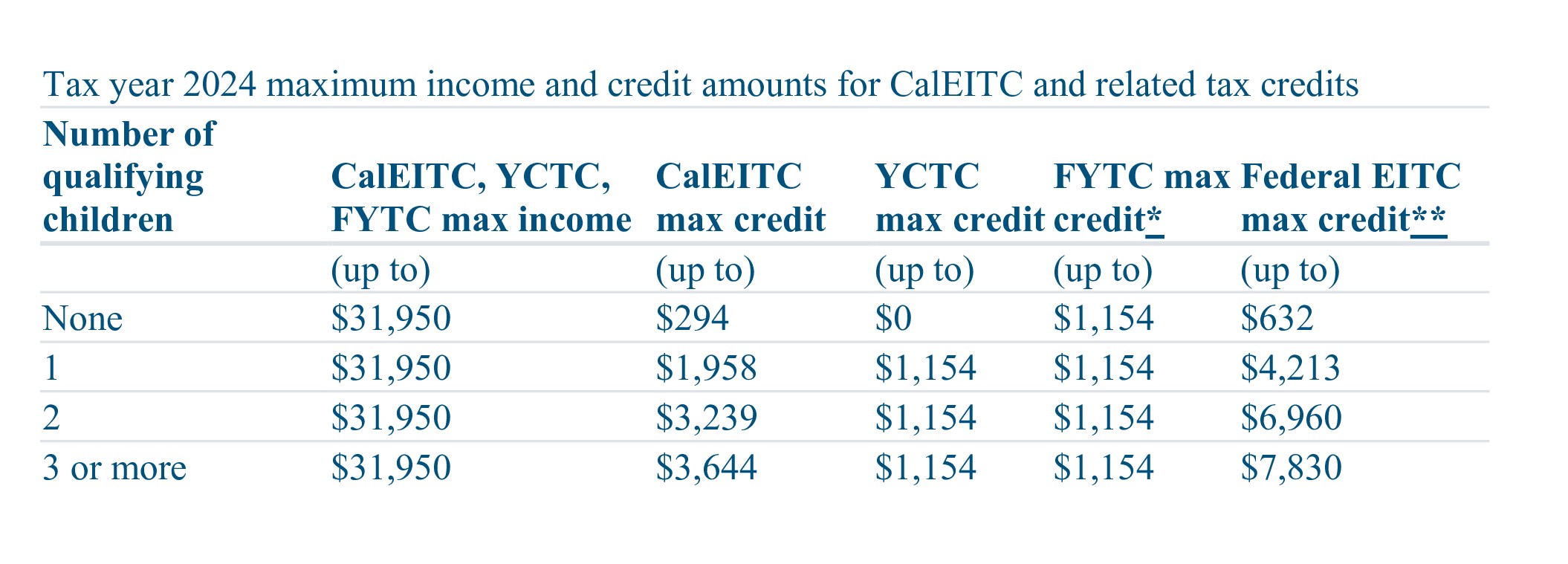

Who Qualifies for CalEITC and Young Child Tax Credit?

If you have low income and work, you may qualify for CalEITC. This credit gives you a refund or reduces your tax owed.

If you meet the CalEITC requirement and have a child younger than 6 years old all of the 2025 tax year, you may also qualify for the Young Child Tax Credit. The maximum filers may receive is $1,154 per family.

Together, these state credits can put hundreds or even thousands of dollars in your pocket. Filing your state tax return is required to claim both of these credits.

Check if you qualify for CalEITC

You may qualify for CalEITC if:

- You’re at least 18 years old or have a qualifying child.

- You have earned income of at least $1 and not more than $31,950

The amount of CalEITC you may get depends on your income and family size.

You must:

- Have taxable earned income.

- Have a valid Social Security Number or ITIN for you, your spouse, or any qualifying children.

- File jointly if married.

- Have lived in California for more than 6 months in 2025.

- Cannot be claimed as a dependent on someone else’s tax return

Sources of earned income

Income can be from:

- W-2 wages.

- Self-employment.

- Tips.

- Other employee wages subject to California withholding.

What you’ll get

Review the chart below to see how much you may get when you file your tax year 2025 return. The following income guidelines for the 2025 Tax Year will help you determine if you may be eligible for CalEITC. The threshold is based on

HOW MUCH CAN I RECEIVE FROM CALEITC?

How much can I get back? – CalEITC Calculator

Will this affect my government benefits?

Participation in free tax preparation or any other additional services will not impact CalWORKS, CalFRESH, or Medi-Cal benefits.

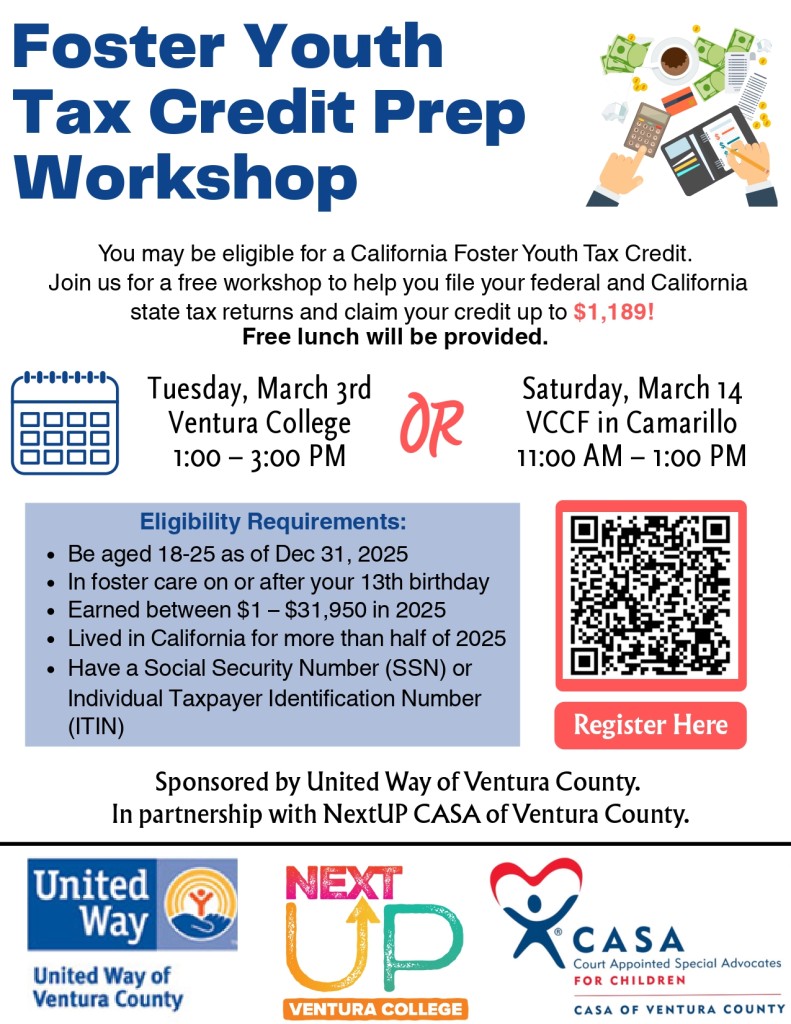

Foster Youth Tax Credit

You may qualify for up to $1,189 cash back if you were in California foster care at age 13 or older and were ages 18-25 at the end of the tax year for current or former foster youth.

Achieve Your Financial Goals

MyMoneyPath empowers you to take control of your financial journey with tailored resources and interactive content. Build skills and gain the confidence to achieve your financial goals. Visit https://www.mymoneypath.org/ for more information.

For more information, call 805.485.6288, x226.

Thank you to our generous program sponsor!