The Earn It! Keep It! Save It! Volunteer Income Tax Assistance (VITA) program is a community partnership led by United Way of Ventura County, the County of Ventura Human Services Agency, Cabrillo Economic Development Corporation, and the IRS to provide preparation and electronic filing of federal and state tax returns free of charge for low and moderate income earners. Earn It! Keep It! Save It! helps tax payers with earnings below $54,000 to file their tax return and access the Earned Income Tax Credit and other tax credits to which they are eligible.

CalEITC: California has an Earned Income State Credit for working families that is modeled after the federal credit. It requires earned income.

-

Eligible sources of earned income are from: W-2 wages, salaries, self-reported income, tips or other employee compensation subject to California withholding.

-

Your investment income, such as interest, dividends, royalties, and capital gains cannot exceed $3,400 for the entire tax year.

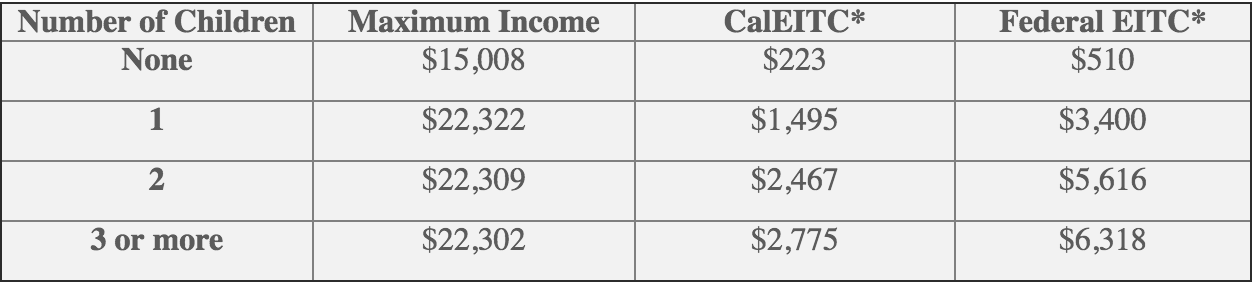

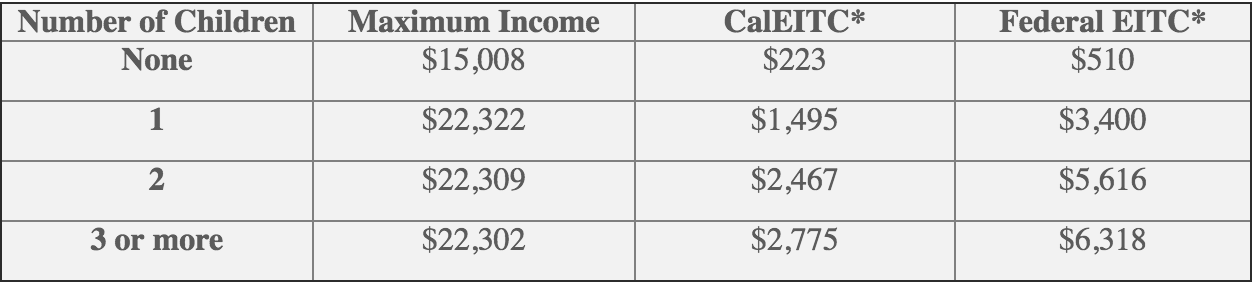

Review the chart below to see if you may be eligible and how much you may qualify for when filing your 2017 tax return.

Using VITA: Volunteer Income Tax Assistance (VITA) sites prepare and e-file federal and state income tax returns for low/moderate income earners at no charge. VITA sites are open from January 31st through April 30, 2018 and are located in Santa Paula, Ventura, Oxnard, Thousand Oaks, Moorpark, and Simi Valley.

Beginning January 22, individuals can call 2-1-1 to schedule an appointment at any of the VITA locations.

See the Earn It! Keep It! Save It! flyer for a list of sites and what you need to bring to your tax preparation appointment.

MyFreeTaxes: Know someone who prefers to file their own income tax return online? MyFreeTaxes http://myfreetaxes.org/ allows taxpayers with earned income under $64,000 who are computer savvy, and with an e-mail address to file their taxes for free.

Get Involved: You can help families & individuals with earnings below $54,000 file their return and claim the tax credits they’re entitled to for the 2017 tax year.

Intake volunteers, especially bilingual English/Spanish are needed to assist at each of the VITA sites. Volunteers are asked to give 4 hours per week during the tax season, January 31st through April 30th and will assist tax filers in completing the intake form, making sure they have all the necessary forms for their tax return to be completed. Volunteers must complete the online Standards of Conduct training and will work under the direction of the VITA site coordinator.